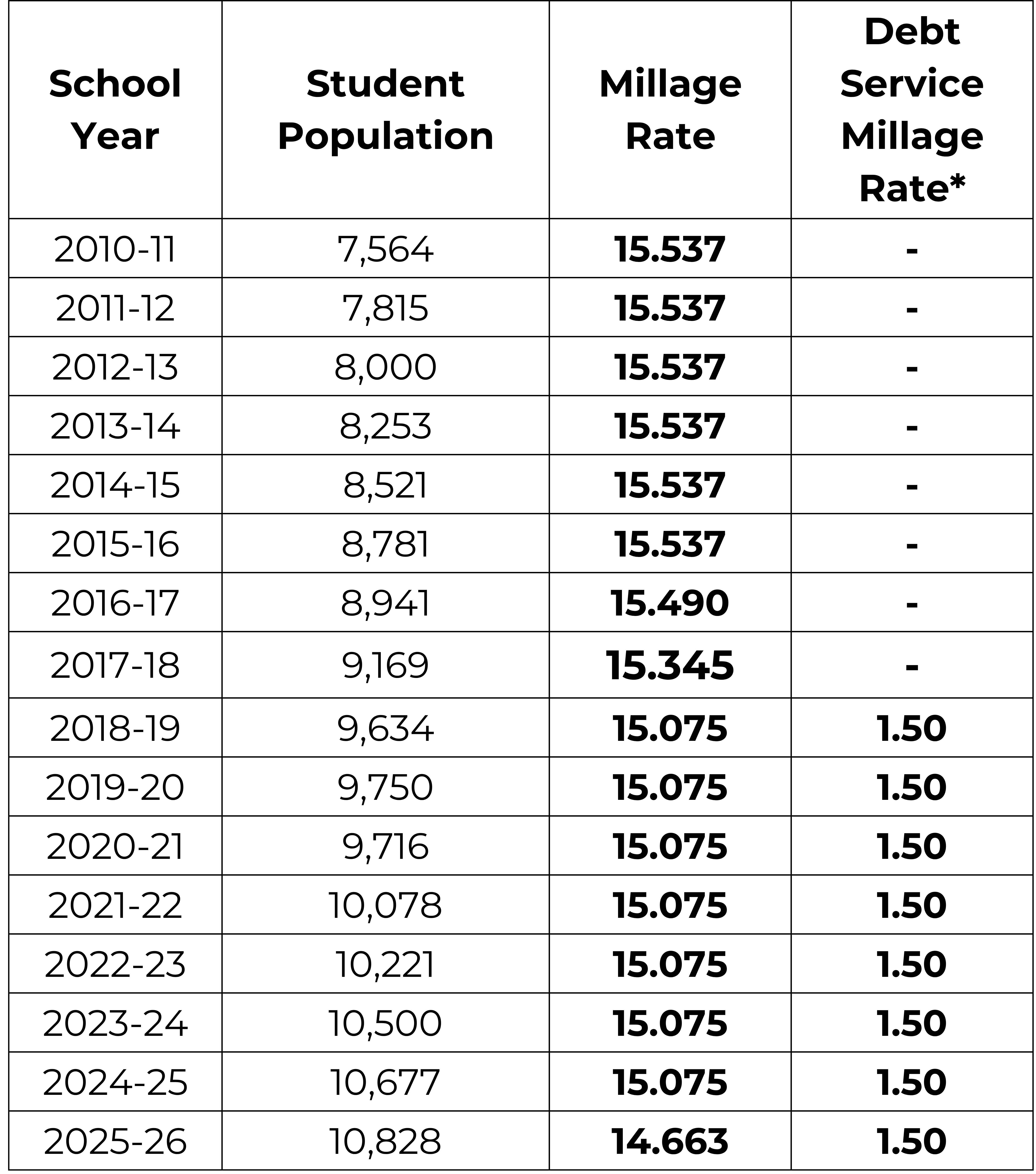

The Need for New Schools & Debt Service Millage Rate

What is a Capital Project?

These are efforts that Bryan County Schools takes to accommodate for significant growth and aging schools and facilities. This is sometimes referred to as renovations and new construction.

How do High Growth School Systems fund and pay for Capital Projects?

Bryan County voters authorize Bryan County Schools to sell bonds for capital projects.

Bryan County Schools then assess a debt service millage rate to help pay back those bonds.

What can a Debt Service Millage Rate be used for?

It can only be used for paying back bond debt.

What is Debt Service Millage Rate?

The debt service millage rate is a way for school districts to raise money from property taxes to pay off debt they owe as a results of selling short and long-term bonds for big projects like building new schools.

EXAMPLE:

Imagine Bryan County School sold bonds to build a new school. To pay that money back, they set a debt service millage rate of 1.5 mills. If your house has a taxable value of $100,000, you’d pay $150 in taxes (1.5 mills x $100,000 / 1,000). This money goes directly to paying off the debt from building the school.

In short, the debt service millage rate is a small part of property taxes that helps Bryan County Schools pay back money it borrowed for important projects like building new schools.

*last updated October 2025